Mutual Funds – Features, Pricing, Distributions – Series 7 Exam

- April 1, 2025

- Posted by: 'FINRA Exam Mastery'

- Category: Finance

🧾 Mutual Funds – Features, Pricing, Distributions – Series 7 Exam

📘 Essential Concepts You Must Know About Mutual Funds for the Series 7 Exam

Mutual funds are a core investment product tested on the Series 7 exam, and understanding their features, pricing mechanisms, and distribution practices is crucial. Here’s a clean and focused breakdown that hits exactly what you need to remember.

🎯 1. Key Features of Mutual Funds

- Diversification:

Mutual funds invest in a basket of securities, which spreads risk across multiple holdings. - Professional Management:

A portfolio manager makes all investment decisions according to the fund’s stated objective. - Liquidity:

Investors can redeem (sell) shares back to the fund at the next calculated NAV (Net Asset Value), typically daily. - Regulated Under:

- Investment Company Act of 1940

- Registered with the SEC.

- Open-End Structure:

Mutual funds issue new shares continuously and redeem existing shares — they are not traded on secondary markets like stocks. - Voting Rights:

Shareholders vote on:- Changes to investment objectives

- Changes in fund managers or advisers

- Mergers or reorganizations

🎯 2. Mutual Fund Pricing – Net Asset Value (NAV)

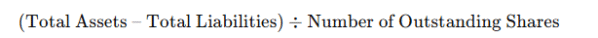

Net Asset Value (NAV) =

- NAV is calculated once per day, typically at market close (4 PM ET).

- Purchases and redemptions occur at the next calculated NAV after the order is received — known as forward pricing.

- NAV per share increases if the fund’s investments appreciate or the fund receives income (dividends/interest).

- NAV per share decreases if fund investments lose value or distributions are made.

🎯 3. Public Offering Price (POP)

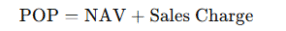

For mutual fund buyers, the Public Offering Price (POP) is:

Where:

- Sales Charge (also called the “load”) is a fee paid to the selling broker.

- Front-end loads are added to the NAV at the time of purchase.

Example:

- NAV = $10.00

- Sales charge = 5%

POP =

🎯 4. Sales Charges and Share Classes

| Share Class | Key Feature |

|---|---|

| Class A Shares | Front-end load; lower ongoing expenses |

| Class B Shares | Back-end load (contingent deferred sales charge) |

| Class C Shares | Level load (small annual charge); no front or back load |

- Breakpoint Discounts:

Available for Class A shares when investing larger amounts. - Letter of Intent (LOI):

Allows an investor to qualify for a breakpoint immediately by committing to invest a certain amount over 13 months.

🎯 5. Distributions

- Dividends and Capital Gains:

- Mutual funds must distribute at least 90% of their net investment income to shareholders to qualify as a regulated investment company (RIC) and avoid taxation at the corporate level.

- Distributions can be paid monthly, quarterly, or annually.

- Types of Distributions:

- Dividend Income: From stocks held by the fund.

- Interest Income: From bonds held by the fund.

- Capital Gains Distributions: From selling securities in the fund for a profit.

- Taxation:

- Investors pay taxes on distributions in the year they are received, even if reinvested.

🎯 6. Breakpoints, Rights of Accumulation, and LOI

- Breakpoint:

Dollar thresholds at which sales charges are reduced for Class A shares. - Rights of Accumulation:

Allow investors to use the total value of their holdings to qualify for a reduced sales charge on new purchases. - Letter of Intent (LOI):

Investor promises to buy enough mutual fund shares over 13 months to reach a breakpoint.

🎯 7. 12b-1 Fees

- 12b-1 Fee:

An annual marketing or distribution fee included in a mutual fund’s expense ratio. - Charged regardless of fund performance.

- Funds with 12b-1 fees higher than 0.25% cannot call themselves no-load funds.

🚀 Conclusion: Focus Points for the Series 7 Exam

✔ Understand how NAV and POP are calculated.

✔ Know the different share classes and types of sales charges.

✔ Be clear on distribution types and tax consequences.

✔ Remember key rules about breakpoints, rights of accumulation, and letters of intent.

Mutual funds are a core exam topic — mastering these concepts is essential for a strong Series 7 performance!

🎓 Need more Series 7 focused study guides and practice exams?

Get expert materials at:

👉 https://finra-exam-mastery.com

Prepare smart. Pass strong. Be ready for anything the exam throws your way!