Portfolio Management – Series 7 Exam

- April 1, 2025

- Posted by: 'FINRA Exam Mastery'

- Category: Finance

🧾 Portfolio Management – Series 7 Exam

📘 Key Concepts You Must Know for Portfolio Management on the Series 7

Portfolio management is a critical section of the Series 7 exam. Questions often test your understanding of how to allocate assets, assess client profiles, and apply investment strategies based on risk and return objectives. Here’s a clean and focused summary to sharpen your preparation for the portfolio management topics.

🎯 1. Investment Objectives and Client Profiles

Successful portfolio management begins with understanding the client’s investment objectives, including:

| Objective | Primary Focus | Example Investments |

|---|---|---|

| Preservation of Capital | Minimize loss | Treasury securities, money market funds |

| Income | Generate regular cash flow | Bonds, preferred stocks, dividend stocks |

| Growth | Increase portfolio value | Common stocks, equity mutual funds |

| Speculation | High risk for high return | Options, penny stocks, leveraged ETFs |

| Tax Minimization | Reduce tax burden | Municipal bonds, tax-managed funds |

📌 Key Tip: Always match the recommendation to the client’s risk tolerance, time horizon, and investment goals.

🎯 2. Asset Allocation and Diversification

Asset allocation involves dividing a portfolio among different asset classes to balance risk and reward according to the investor’s goals.

- Strategic Asset Allocation: Long-term fixed percentage across asset classes.

- Tactical Asset Allocation: Short-term adjustments based on market conditions.

Diversification reduces unsystematic risk by spreading investments across various securities, industries, or asset classes.

📌 Key Tip:

- Stocks + Bonds + Cash = Basic diversification.

- Within stocks: Different sectors (tech, health care, utilities) for deeper diversification.

🎯 3. Risk and Return Concepts

| Type of Risk | Description |

|---|---|

| Systematic Risk | Market risk – cannot be diversified away (interest rates, inflation, recessions) |

| Unsystematic Risk | Company/industry-specific risk – can be reduced through diversification |

| Liquidity Risk | Difficulty selling assets quickly without losing value |

| Inflation Risk | Erosion of purchasing power |

| Reinvestment Risk | Risk that future proceeds will be reinvested at lower rates |

Expected Return = Weighted average of possible returns based on probability.

🎯 4. Modern Portfolio Theory (MPT)

MPT focuses on constructing portfolios to maximize expected return for a given level of risk.

- Efficient Frontier: Set of optimal portfolios offering the highest expected return for a defined level of risk.

- Correlation: Combining assets with low or negative correlation improves diversification.

📌 Key Tip: Perfect diversification = combining assets that move in opposite directions.

🎯 5. Portfolio Rebalancing

Over time, portfolios drift from original allocations due to market movements.

- Periodic Rebalancing: Reset to target allocations at regular intervals (e.g., yearly).

- Threshold Rebalancing: Reset when an asset class exceeds a set deviation (e.g., +/- 5%).

Benefit: Maintains risk profile aligned with client’s objectives.

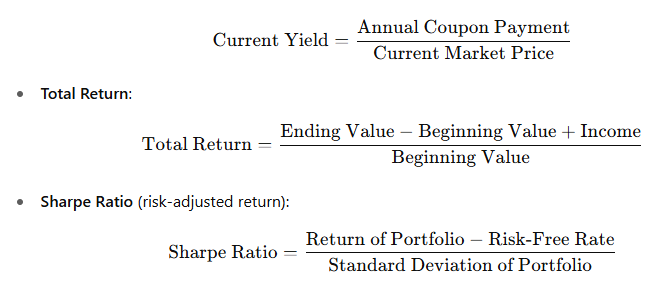

🎯 6. Key Formulas You Must Know

- Current Yield (for bonds):

🚀 Conclusion: Mastering Portfolio Management for Series 7

Focus on understanding:

- How client goals dictate portfolio choices

- Why asset allocation and diversification matter

- How to manage different types of investment risk

- Core formulas like current yield and total return

Mastering portfolio management is crucial not just for the Series 7, but for building client trust and managing real-world portfolios.

🎓 Need full Series 7 study tools, practice exams, and flashcards?

Start now at

👉 https://finra-exam-mastery.com

Learn smarter. Pass faster. Build your future in finance!