Return on Investment – Series 7 Exam

- April 1, 2025

- Posted by: 'FINRA Exam Mastery'

- Category: Finance

🧾 Return on Investment – Series 7 Exam Focus

📘 Understanding ROI Calculations and Concepts for Securities Licensing Success

The Return on Investment (ROI) is a fundamental financial concept tested on the Series 7 exam. You need to know how to calculate it, when to apply it, and what it indicates about an investment’s performance. Here’s a sharp, exam-focused review of ROI concepts and formulas.

🎯 1. What Is Return on Investment (ROI)?

Definition:

ROI measures the profit or loss generated by an investment relative to its cost. It is used to evaluate the efficiency or profitability of an investment.

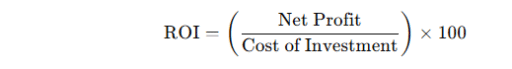

📈 2. ROI Formula

The basic formula for ROI is:

Where:

- Net Profit = (Total Proceeds – Total Cost)

✅ Key Points for the Exam:

- ROI is always expressed as a percentage.

- ROI evaluates performance over a specific time period, but it does not account for time value of money unless modified (e.g., IRR).

🧮 3. ROI Calculation Examples

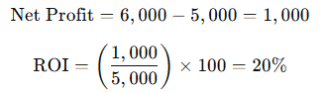

Example 1: Stock Investment

- Buy 100 shares at $50 each = $5,000 investment.

- Sell 100 shares at $60 each = $6,000 proceeds.

✅ Result: ROI is 20%.

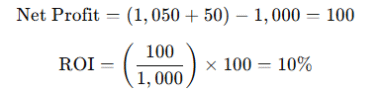

Example 2: Bond Investment with Interest

- Buy a bond for $1,000.

- Sell the bond for $1,050 after 1 year.

- Receive $50 in coupon payments.

✅ Result: ROI is 10%.

🧠 4. ROI vs. Related Measures You Might See on Series 7

| Measure | Focus | Key Difference |

|---|---|---|

| ROI | Profit relative to cost | No time component |

| Yield | Income return (e.g., dividends, coupons) | Focused only on income |

| Total Return | Income + capital gains | Full picture, not just cost-based |

| Internal Rate of Return (IRR) | Annualized return over multiple periods | Accounts for time value of money |

⚡ 5. Common Mistakes to Avoid on the Series 7 Exam

- ❌ Forgetting to include dividends or coupon payments when calculating profit.

- ❌ Mixing up cost basis if there have been stock splits or reinvestments.

- ❌ Ignoring fees or commissions if the question specifically includes them.

🚀 Quick Exam Tip for ROI Questions

👉 Always double-check whether the question asks for total return, annualized ROI, or just basic ROI.

👉 If dividends, interest, or commissions are mentioned, factor them into net profit unless the question says otherwise.

🎓 Want full Series 7 math drills and exam simulations?

Access study guides, practice exams, and calculation walkthroughs at

👉 https://finra-exam-mastery.com

Learn it. Practice it. Pass it. 📈