Series 6 Exam Vocabulary You Must Master

- April 1, 2025

- Posted by: 'FINRA Exam Mastery'

- Category: Finance

🧾 Series 6 Exam Vocabulary You Must Master

📘 Essential Terms for the Investment Company and Variable Contracts Products Representative Exam

The Series 6 exam tests your knowledge of investment products, securities regulations, account types, and client recommendations. Success on this exam requires strong command of the most common vocabulary and key concepts. Use this list to focus your study and reinforce your understanding.

💡 Core Series 6 Vocabulary Terms

1. Mutual Fund

An investment vehicle that pools money from many investors to purchase a diversified portfolio of stocks, bonds, or other securities, managed by a professional fund manager.

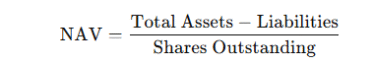

2. NAV (Net Asset Value)

The price per share of a mutual fund, calculated as:

3. Sales Charge (Load)

A fee paid when purchasing (front-end load) or redeeming (back-end load) mutual fund shares. No-load funds do not charge these fees.

4. Prospectus

A legal document provided to potential investors that contains details about an investment offering, including objectives, risks, fees, and management.

5. Variable Annuity

A contract with an insurance company where the value fluctuates based on the performance of selected investment options, offering tax-deferred growth.

6. 12b-1 Fee

An annual marketing or distribution fee charged by some mutual funds, expressed as a percentage of assets.

7. Surrender Charge

A fee charged to annuity holders who withdraw funds during the early years of the contract.

8. Breakpoint

A dollar amount at which a mutual fund investor qualifies for a reduced sales charge.

9. Letter of Intent (LOI)

A statement by an investor indicating they intend to invest enough over a set period to qualify for a breakpoint discount.

10. Rights of Accumulation (ROA)

Allows mutual fund shareholders to receive sales charge discounts by combining new purchases with existing holdings.

11. Transfer Agent

An entity responsible for issuing and redeeming fund shares and maintaining shareholder records.

12. Custodian

A financial institution that holds securities for safekeeping as part of a mutual fund or investment plan.

13. SIPC (Securities Investor Protection Corporation)

A nonprofit corporation that protects customers if a brokerage firm fails, covering up to $500,000 per account.

14. FINRA (Financial Industry Regulatory Authority)

The self-regulatory organization overseeing broker-dealers and enforcing rules for Series 6 and other exams.

15. Suitability

A regulatory requirement that recommendations must be appropriate for a client’s financial situation, goals, and risk tolerance.

16. Principal Approval

Requirement that a firm’s principal must review and approve new accounts and most transactions.

17. LIFO & FIFO (Last In, First Out / First In, First Out)

Methods for determining the cost basis of mutual fund shares sold or redeemed.

18. Custodial Account (UGMA/UTMA)

Accounts set up for minors that allow an adult to manage assets until the child reaches the age of majority.

19. 529 Plan

A tax-advantaged savings plan for future education expenses.

20. Exchange Privilege

The right to transfer investments within a mutual fund family without incurring a new sales charge.

🧠 Memory Tip

Create flashcards for these terms. Review daily, focusing on those you find most challenging.

🎓 Ready to boost your Series 6 vocabulary mastery?

Get more study aids and practice questions at:

👉 https://finra-exam-mastery.com

Know these terms—score higher, faster!