Series 7 Deep Dive – Bond Calculations

- April 1, 2025

- Posted by: 'FINRA Exam Mastery'

- Category: Finance

🧾 Series 7 Deep Dive – Bond Calculations

📘 Mastering Bond Calculations for the Series 7 Exam

Understanding bond calculations is an essential part of the Series 7 exam. Bonds are one of the primary debt securities and understanding how to calculate their yield, price, and interest payments is key to passing the exam. Here’s a deep dive into the most important bond calculations you’ll need to know for the Series 7 exam.

🎯 1. Bond Basics: Key Concepts

Before diving into the calculations, let’s review a few key terms related to bonds:

- Face Value (Par Value): The amount the bondholder will receive at maturity, typically $1,000 for most bonds.

- Coupon Rate: The annual interest rate the bond pays based on its face value. For example, a 5% coupon bond will pay $50 per year on a $1,000 bond.

- Current Yield: The bond’s annual interest divided by its current market price.

- Yield to Maturity (YTM): The total return anticipated on a bond if it is held until maturity, accounting for the bond’s current price, coupon payments, and the face value repayment.

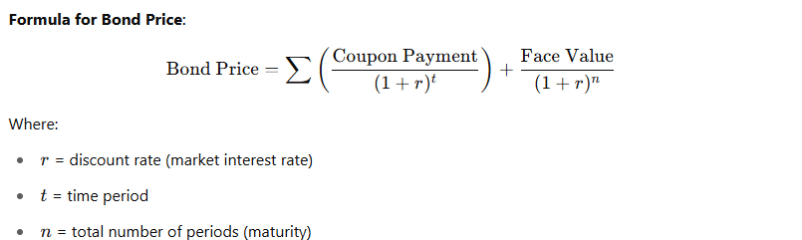

🎯 2. Bond Pricing

The price of a bond is determined by the market interest rates and its coupon rate. When interest rates rise, the price of a bond generally falls, and vice versa. Bonds can be priced at:

- Par: The bond is priced at 100, or its face value.

- Premium: The bond is priced above par (more than $1,000) when its coupon rate is higher than the current market interest rates.

- Discount: The bond is priced below par (less than $1,000) when its coupon rate is lower than the current market interest rates.

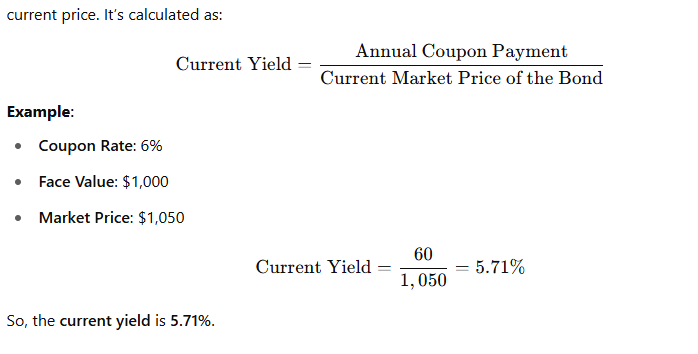

🎯 3. Current Yield Calculation

The current yield is a measure of the annual income an investor will earn from a bond as a percentage of its

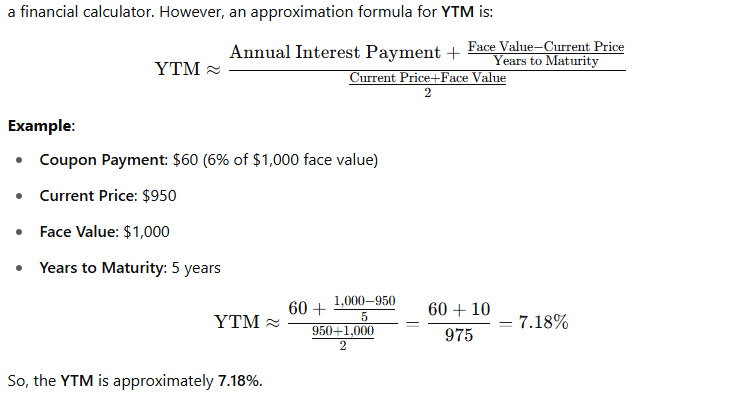

🎯 4. Yield to Maturity (YTM) Calculation

Yield to Maturity (YTM) is the total return an investor can expect if the bond is held until maturity, taking into account the bond’s current price, coupon payments, and face value repayment.

Calculating YTM requires solving for the rate rrr in the bond pricing equation, which involves trial and error or

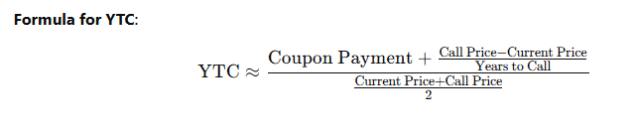

🎯 5. Yield to Call (YTC) Calculation

For callable bonds, the yield to call (YTC) is the yield an investor will earn if the bond is called (redeemed early) by the issuer before maturity. This calculation is similar to YTM, but it assumes the bond is called at the call price instead of the face value.

The formula for YTC is the same as the YTM calculation, except the call date and call price are used instead of maturity and face value.

🎯 6. Bond Duration and Interest Rate Sensitivity

Duration measures a bond’s price sensitivity to interest rate changes. Longer-duration bonds are more sensitive to interest rate changes than shorter-duration bonds.

- Modified Duration: The percentage change in the bond price for a 1% change in interest rates. A bond with a modified duration of 5 years will decrease in price by 5% for every 1% rise in interest rates.

🚀 7. Conclusion: Mastering Bond Calculations for the Series 7 Exam

Understanding bond calculations is essential for success on the Series 7 exam. Key concepts include calculating current yield, yield to maturity (YTM), and yield to call (YTC), as well as understanding bond pricing and duration. By mastering these calculations, you will be well-prepared for the questions related to bonds on the exam.

🎓 Ready to take your Series 7 prep to the next level?

Explore study materials, practice questions, and resources to strengthen your understanding of bond calculations and other key Series 7 topics at

👉 https://finra-exam-mastery.com

Start preparing today and pass your Series 7 exam with confidence!