Top Formulas to Know for the Series 7 Exam

- April 1, 2025

- Posted by: 'FINRA Exam Mastery'

- Category: Finance

🧾 Top Formulas to Know for the Series 7 Exam

📘 Key Formulas for Mastering the Series 7 Exam

The Series 7 exam is a comprehensive test for aspiring securities professionals, covering a wide range of topics including investment products, market dynamics, and financial regulations. To succeed, you need to be familiar with several key formulas that are frequently tested. Here’s a list of the most important formulas to know for the Series 7 exam.

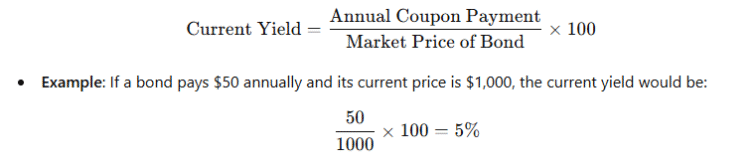

🎯 1. Current Yield Formula

Used to calculate the yield of a bond based on its annual interest and its current market price.

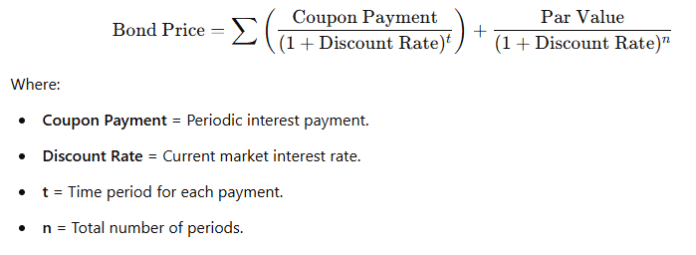

🎯 2. Bond Pricing Formula (Discount/Premium)

To calculate a bond’s price based on its coupon rate, market interest rates, and time to maturity.

- Discount Bond: If the bond is priced below par, the coupon rate is lower than the market interest rate.

- Premium Bond: If the bond is priced above par, the coupon rate is higher than the market interest rate.

- The general bond pricing formula involves the present value of future payments:

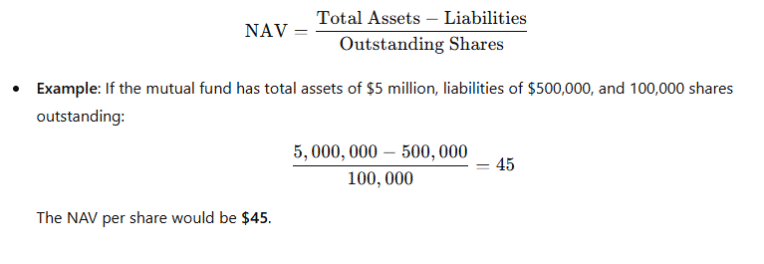

🎯 3. Net Asset Value (NAV) of Mutual Funds

The NAV is the per-share value of a mutual fund, calculated by:

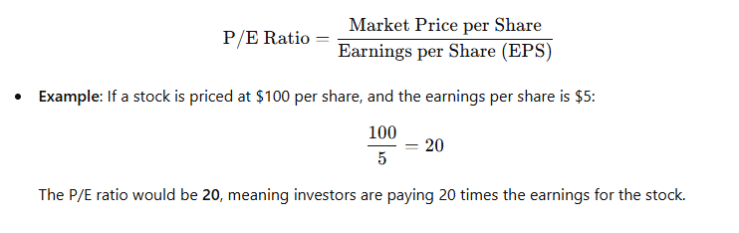

🎯 4. Price-to-Earnings (P/E) Ratio

The P/E ratio measures the price of a stock relative to its earnings per share (EPS). This is a key ratio to assess stock valuation.

🎯 5. Dividend Yield Formula

The dividend yield helps you understand how much return you are getting from a stock’s dividend relative to its current market price.

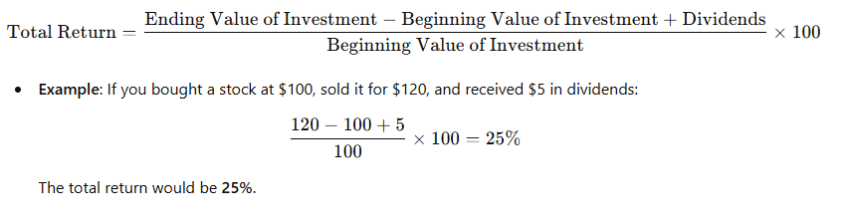

🎯 6. Total Return on Investment (ROI)

Total return measures the overall return on an investment, considering both capital gains and dividends.

🎯 7. Capital Gain Formula

Capital gain is the profit made from the sale of a security:

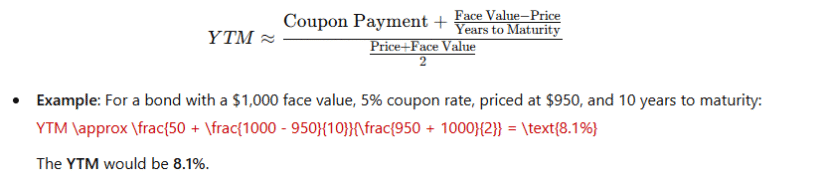

🎯 8. Yield to Maturity (YTM)

Yield to maturity (YTM) is the total return anticipated on a bond if it is held until maturity. It takes into account the bond’s current market price, coupon payments, and time to maturity.

🎯 9. Yield to Call (YTC)

Yield to call is the yield on a callable bond if it is called before its maturity date.

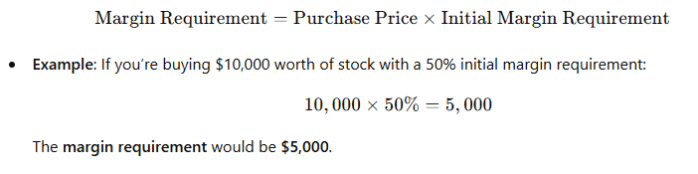

🎯 10. Margin Requirement Formula

To calculate the minimum amount of equity needed for a margin account:

🚀 Conclusion

Mastering these key formulas is essential for success on the Series 7 exam. They help you understand the calculations and concepts that are frequently tested, particularly in areas like bond pricing, yield analysis, and investment returns. Be sure to practice applying these formulas to various practice problems to ensure you’re ready for exam day.

🎓 Need expert help preparing for the Series 7 exam?

Get access to study guides and practice questions at

👉 https://finra-exam-mastery.com

Prepare with confidence and pass the Series 7 exam!